Best 5 NBFC Loan app for instant personal loan 2022-2023 In this article, I will tell you about a mobile application that is popular for giving instant loans and it is also verified by all NBFCs, with these applications you can take a loan of up to 5 lakhs, that too through Aadhar card and PAN card.

There are many such companies in time that give loans but keep the interest rate very high, these apps give you instant loans, in this article I will tell you about 5 such applications which were the best in 2022, let us tell them one by one.

1. SPEEDFINANCE INSTANT PERSONAL LOAN APP

The company has come from earn wealth solution pvt ltd, it has a 4.2 rating on playstore, now it has 100K downloads that the company gives you a loan of minimum 5 thousand and maximum 5 lakh, here you get loan from 3 months to 12 months And for these you have to apply online and there is 100% paper lass work in this, when you get the loan when you have all the documents complete if you take a loan of 50,000 from here you will get 30% interest.

To get the loan, for this you have to pay a processing fee of 1000 ₹ and when you repayment for 3 months, you will have to pay Rs 53760, your minimum age for taking the loan is 23 years and the maximum age is 54 years, for this you have to go to a private company or any government.

There should be empoly in the company because your income is also seen in this, to take loan in this, your one month income should be less than 15000 rupees, your civil score should not be less than 600 then only you will be able to apply for loan For this, you should have Aadhar card, PAN card, and address proof in the document along with it. There should also be a statement. You get the loan only after all these are done.

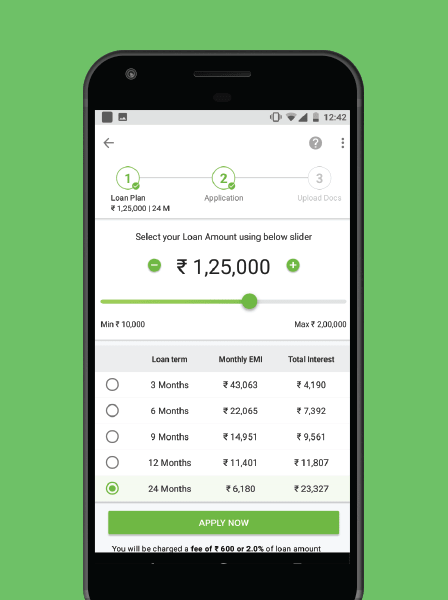

2. MONEY VIEW LOAN

Money view is the top company inside India, it gives loan on the company’s Aadhar card, PAN card, it currently has a 4.1 rating on playstore, has more than 10M downloads, this company gives you a loan from 1000 ₹ to 5 lakh rupees, for which 15 % APR has to be paid minimum and maximum 39% on this you get loan for 5 years for example if you take a loan of Rs 50 thousand from here for 24 months at 18% per APR interest then the interest you will get That will be 11680 ₹ To take this loan, you should be an Indian citizen, you should have a monthly income, to take this loan, your minimum age should be 18 years and maximum age should be 50 years, after which you can get the loan.

3. i2ifanding.com

This company is also tremendous, this company will give you 100% loan if you have document complete, they have 2.1 rating on playstore, its download is more than 100K, with this application you can also take loan and you can also give this company also from NBFC Verified, you can get a loan of minimum 25 thousand and maximum 5 lakh here To take this loan loan on APR interest,

you have to pay processing fee from 2% to 5%, whatever loan is taken, the documents required to take loan are like this Aadhar card, PAN card, address proof, gas bill Electricity bill, water bill, home registration and bank statement of last 12 months along with income proof will also have to be given, after which this company can give you loan.

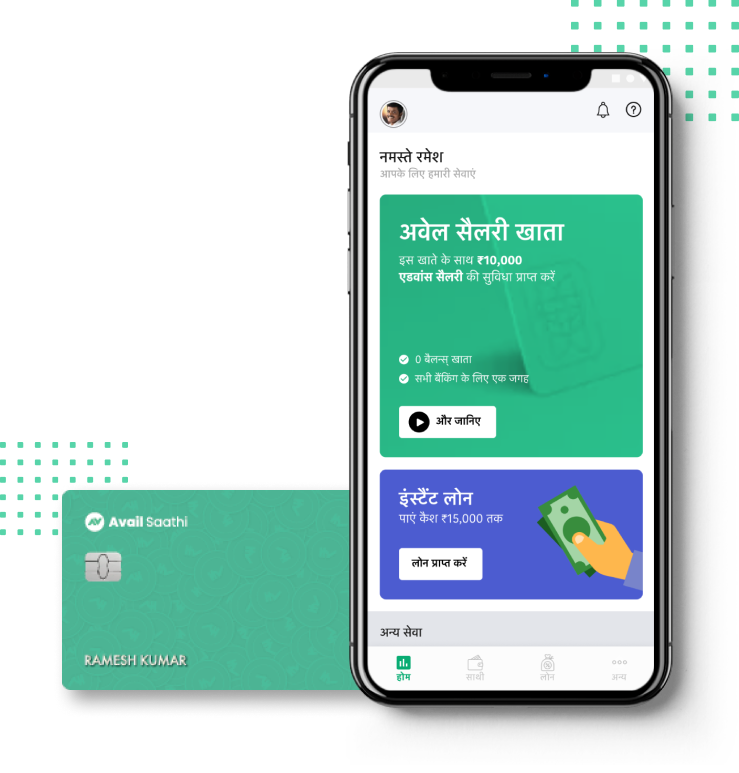

4. AVAIL Instant personal apps

This company has a 4.0 rating on playstore, it has been downloaded more than 1M times, this company can give you a loan in any emergency, this company is the number 1 finance company in India, from this company you can get 90 days to 240 days. T

o get a loan, for this you have to pay an interest of 1% to 3%, for this the time of repayment is from 3 months to maximum 8 months, for this the APR is 60% for example if you Take a loan of 20 thousand for 8 months at 2% per APR, then your processing fee for this will be 400 ₹, after that this company puts 20 thousand rupees in your account, for this your EMI will be Rs 2950, for this you have to KYC Aadhar Card, Pan Card, Bank Account, Bank Account Statement, Income Proof, and you can take all types of loans from this.

5. FLEXSALARY instant personal apps

This company is also very popular for instant loan, it has got a rating of 4.1 on playstore, it has more than 1M download, in this also you can apply for loan, from which company you can get loan up to 2 lakh and having flexible EMI To take this loan online, you can apply in it. To take this loan, you have to provide very few documents.

To take this loan, you must be an Indian citizen, your income must be proficient, your age is at least You should be 21 years, your monthly income should be at least 8000, only then you can get loan, to take loan, you will have to give your Aadhar card, PAN card, bank statement, a photo, but you will get loan for maximum 3 years. Maybe if all your documents are correct then you can get a loan.